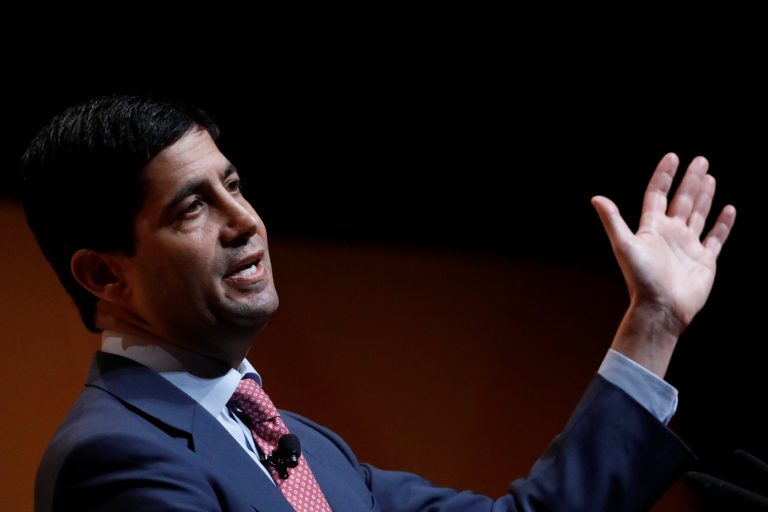

Kevin Warsh: From Fed Governor to Trump’s Pick for Federal Reserve Chair

In a highly anticipated move, U.S. President Donald Trump has nominated Kevin Maxwell Warsh to become the next Chair of the Federal Reserve, signaling a potential shift in U.S. monetary policy at one of the most critical economic junctures in recent history.

A Storied Financial Career

Kevin Warsh, 55, is a seasoned American financier and former member of the Federal Reserve Board of Governors, where he served from 2006 to 2011. Appointed during the George W. Bush administration and retained under President Barack Obama, Warsh became the youngest Fed governor in history at age 35.

During his tenure at the Fed, Warsh played a central role during the 2008 financial crisis, serving as the bank’s liaison to Wall Street and representing the Federal Reserve in global economic forums such as the Group of Twenty (G20).

After leaving the Fed, Warsh transitioned into academia and economic policy work. He became the Shepard Family Distinguished Visiting Fellow in Economics at Stanford University’s Hoover Institution and lectured at the Stanford Graduate School of Business.

Nomination by President Trump

On January 30, 2026, Trump officially announced his intention to nominate Warsh as the next Fed Chair, succeeding Jerome Powell, whose term expires in May 2026. This nomination spotlights both Warsh’s experience and Trump’s desire for leadership aligned with his economic goals.

Trump praised Warsh on social media, describing him as a highly capable leader who could become “one of the great Fed Chairmen,” and emphasized his confidence in Warsh’s economic vision.

A Potential Shift in Monetary Policy

Warsh is widely viewed as a figure with strong monetary policy insight. Historically seen as an inflation “hawk”—favoring measures to keep inflation in check—he has recently aligned with calls for lower interest rates and a reduced Fed balance sheet, positions that more closely mirror Trump’s economic priorities.

In public comments before his nomination, Warsh advocated for “regime changes” in how the Fed operates, suggesting closer policy cooperation with the U.S. Treasury and a reassessment of traditional data-driven approaches to monetary policy.

Market and Political Reactions

Financial markets reacted swiftly to the nomination news, with currencies and asset prices adjusting on anticipation of Warsh’s policy direction. His selection also stirred debate about the independence of the Federal Reserve, given President Trump’s prior criticisms of Powell and calls for rate cuts.

The nomination now heads to the U.S. Senate for confirmation, where lawmakers will evaluate not only Warsh’s qualifications but also broader questions about central bank autonomy and political influence.

Looking Ahead

If confirmed, Warsh will steer the Federal Reserve during a time of economic uncertainty marked by concerns over inflation, growth, and financial market stability. His leadership could redefine how the Fed interacts with government policymakers and responds to shifting global economic conditions.